An appetite for growth

Exploring the findings of CBRE’s recently-released UK Healthcare Sentiment Survey

Investment in healthcare real estate is experiencing a revival ahead of other sectors, according to a new report from CBRE UK.

The real estate adviser’s 2024 UK Healthcare Sentiment Survey quizzed more than 200 investors, developers, and providers – collectively investing £8bn and operating 150,000 beds – to gain valuable insight into the market.

And it revealed that healthcare demand remained robust in 2023, with a high majority of investors and developers having maintained or increased their focus on the sector despite economic challenges and low investment volumes.

Market participants are also taking a long-term view on the sector based on increasing demand and strengthening operational performance, with ESG credentials key to decision making as they enhance the positive social impact healthcare services can deliver through the reduction of operational costs and the creation of operational efficiencies which support the provision of high-quality care.

Sarah Livingston, head of UK healthcare at CBRE, told Healthcare Property: “What the report showed was that healthcare is a priority sector, which will likely rebound in September this year, ahead of many other sectors in the market.

“What has stopped real estate investment on the whole is that estates have not performed, but health and social care is the opposite and performance has improved.

“A large part of elderly care market occupancy is back to where it should be and recruitment and staffing are being addressed.

“COVID recovery for private healthcare is also far exceeding pre-COVID levels, so we are seeing investment in the sector rebounding at pace.”

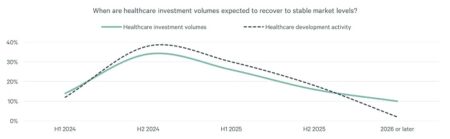

The report reveals that 80% of those questioned expect increased investment and development activity in the health sector in 2024, and 50% anticipate a return to stable market activity before the end of the year.

And more than 75% say ESG influences their strategy moving forward.

But it also highlights a gulf between the priorities of developers and investors.

For example, 50% of investors are interested in the senior living market, but only 30% of developers are interested in developing these facilities.

Developers, in contrast, are focusing their attention on primary care, which investors are less keen to fund.

Livingston said: “Senior living is tricky, with long lead times and issues with planning permissions, which are slow to come by, as are sites with the right access in the right location.

“While, in primary care, there are a large number of GPs operating from buildings which are not fit for purpose.

“Developers are looking at models where you don’t just see a GP, but also other health and wellbeing providers, such as physiotherapists or mental health practitioners, all under one roof.

“This is attractive as it is seen as a long-term income.”

She added: “We are not really seeing much in the way of large-scale hospital projects, rather adaptations for diagnostics and outpatient services closer to home and with good public transport links for both patients and staff.

“A lot of work will be about repurposing these facilities and bringing them up to ESG standards. This is a particular focus for investors who need to prove their environmental credentials. That came across very strongly in the report.”

She concludes: “The overall sentiment is positive about healthcare because it is a well-known, long-term demand that’s not going anywhere

“With the population getting older and needing more-complex care, investors, developers, and providers are now looking at healthcare.”